Irs Schedule A 2024 Deductions – An overwhelming majority of American taxpayers—about 90%—claim the standard deduction on their federal income tax return. And, for most of those people, the standard deduction is the largest tax . and withdrawals for qualified medical expenses are tax-free. Report your contributions on Schedule 1, Line 13, and include Form 8889 with your return. IRA deductions will depend on your income .

Irs Schedule A 2024 Deductions

Source : www.forbes.comIRS unveils new tax brackets, standard deduction for 2024 tax year

Source : www.syracuse.com2024 Form W 4P

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

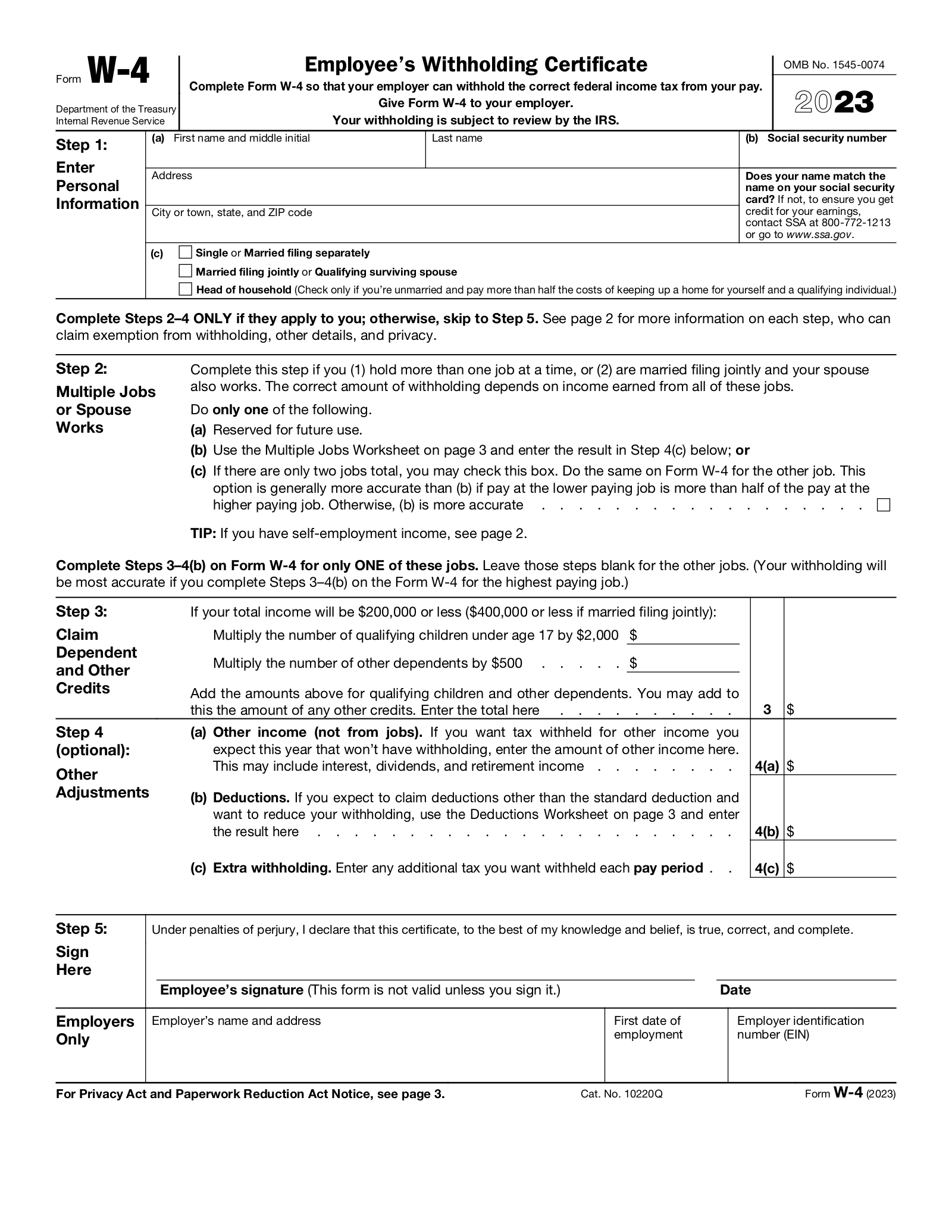

Source : www.investopedia.comEmployee’s Withholding Certificate

Source : www.irs.gov2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.comIRS releases 2024 tax brackets; What is new standard deduction

Source : www.al.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govFree IRS Form W4 (2024) PDF – eForms

Source : eforms.com2024 IRS Tax Brackets and Standard Deductions Optima Tax Relief

Source : optimataxrelief.comIrs Schedule A 2024 Deductions IRS Announces 2024 Tax Brackets, Standard Deductions And Other : W ith its homeowner tax breaks and perks, tax season is one of the few times you can get some cash out of your house instead of pouring money into it. With the steady climb of hom . Tax season is in full swing and, though many people have yet to file, the IRS has already put out an initial report about how things are going. According to this report, the average 2024 tax refund is .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)