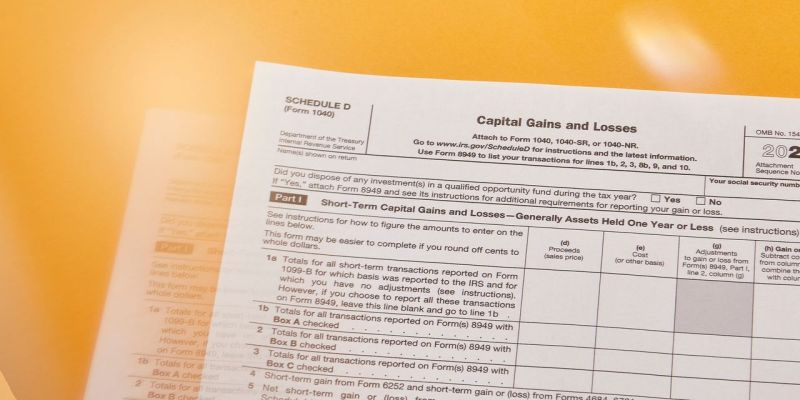

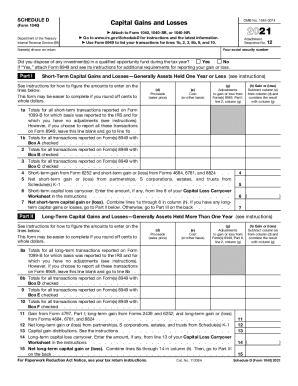

Irs Schedule D 2024 Capital Gains – Schedule D is a summary of your capital gains and losses for the year, while Form 8949 is a supplemental form to show the IRS you did the actual work of tallying it all up. It’s a simple enough . That won’t lower your tax bill now, but it can help you build your savings. All that said, you can also begin planning for 2024. Though you can and then calculate your capital gain or loss, .

Irs Schedule D 2024 Capital Gains

Source : www.investopedia.comIRS Schedule D Walkthrough (Capital Gains and Losses) YouTube

Source : m.youtube.comSchedule D: How To Report Your Capital Gains (Or Losses) To The

Source : www.bankrate.comIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comCapital Gains Tax: What It Is, How It Works, and Current Rates

Source : www.investopedia.comPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.com2023 Instructions for Schedule D Capital Gains and Losses

Source : www.irs.govSchedule D: How To Report Your Capital Gains (Or Losses) To The

Source : www.bankrate.comIrs Schedule D 2024 Capital Gains When Is Schedule D (Form 1040) Required?: The 2024 tax-filing season kicked off on Jan. 29, and along with it, free resources NJ residents can access to help them complete their forms. . If your tax refund isn’t what you imagined, your side gig may be to blame. Read on to learn why else your refund may be lower and what to do about it. .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)